Simple tax return calculator

It can be used for the 201314 to 202122 income years. Try our simple online tax calculator to see how much you could get back this financial year.

Cash App Taxes Review Free Straightforward Preparation Service

Use our quick tax calculator to find out your marginal tax rate and additional tax savings due to RRSP contribution.

. Tax Changes for 2013 - 2022. Important Details about Free Filing for Simple Tax Returns If you have a simple tax return you can file with TurboTax Free Edition TurboTax Live Basic or TurboTax Live Full Service Basic. Your return can be filed after that as well however.

Choose what you would like to calculate. Like the IRS states typically use a special form for an amended return. Advanced Tax Calculator Guide.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Yearly Federal Tax Calculator 202223.

Alternative Minimum Tax form 1040 line 45. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return. Simply enter the details of the principal amount interest rate period and frequency to know the interest earned.

Your household income location filing status and number of personal exemptions. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. A simple tax return excludes self-employment income Schedule C capital gains and losses Schedule D rental and royalty income Schedule E.

Maximise your tax return from 99. If you decide to complete and sign your tax return most people finish in just minutes our qualified accountants check your return and look for suggestions about further deductions or. Use our simple tax calculator to see how much tax youll pay for the 2021-22 financial year and what your tax return may look like.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. To use our calculator simply. Gone are the days of fretting over a calculator surrounded by scraps of paper at the eleventh hour.

The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. Self assessment Tax Return made simple. Second get the proper form from your state and use the information from Form 1040-X to help you fill it out.

See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed. You can efile income tax return on your income from salary. It takes into account the reality that our tax system is progressive which means that those with higher income pay a higher rate.

Youll get a rough estimate of how much youll get back or what youll owe. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Simple Interest Calculator - Use ClearTax simple interest calculator to calculate simple interest.

Information you need for this calculator. AMT taxable income form 6251 line 28. If left at zero calculator will assume your AMT taxable income AGI.

Claim your deductions and get your acknowledgment number online. GoSimpleTaxs software uses the information you upload in real time. Estimate your tax refund with the HR Block tax calculator.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Select the currency from the drop-down list this step is optional. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

File in office Drop in and drop off. To find out what your final tax return summary will look like call 13 23 25 and let our tax accountants walk you through the tax refund process with. You can amend your state tax return in two simple steps.

Get your 2021 tax refund in 10 days by filing your income tax return directly with the CRA or Revenue Quebec using our NETFILE certified program. The filing deadline for an Ontario tax return is April 30 and June 15 for those who are self-employed. The Tax Return Calculator is a free part of the Etax online tax return a paid tax agent serviceThe calculator provides an instant estimate of your tax refund or payable.

Only certain taxpayers are eligible. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. Our personal tax filing software uses only simple easy to.

Offer period March 1 25 2018 at. First fill out an amended federal income tax return Form 1040-X. H and R block Skip to.

May not be combined with other offers. The exact amount of your income tax can only be calculated upon lodgment of your income tax return. You dont need to be an expert to complete your self assessment tax return get started with GoSimpleTax today its free to try.

2022 tax refund calculator with Federal tax medicare and social security tax allowances. High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and phased-out exemptions not shown here in addition to paying a new 396 tax rate and 20 capital gains rate. How do I amend my state tax return.

2022 Marginal Tax Rates Calculator. In simple terms this is the average tax rate you pay. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Stop by an office to drop off your documents with a Tax. It is mainly intended for residents of the US. And is based on the tax brackets of 2021 and 2022.

Estimate your tax refund with HR Blocks free income tax calculator. Estimate your provincial taxes with our free Ontario income tax calculator. Our calculator allows the accurate calculation of simple or compound interest accumulated over a period of time.

Alison Banney Updated Feb 7 2022. Taxable income 87450 Effective tax rate 172. The advanced features of the Tax Form Calculator provide more control of expense deductions and tax credits allowing you to produce an estimation of your annual tax.

Use our simple 2021 income tax calculator for an idea of what your return will look like this year. Meet with a Tax Expert to discuss and file your return in person. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

While you can still opt for a snail mail return check it will take 6-8 weeks versus 21 days for.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Return Estimator Outlet 62 Off Www Cartenztactical Com

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Taxslayer Review 2022 Pros Cons Who Should Use It

How To Calculate Taxable Income H R Block

Tax Return Calculator How Much Will You Get Back In Taxes Tips

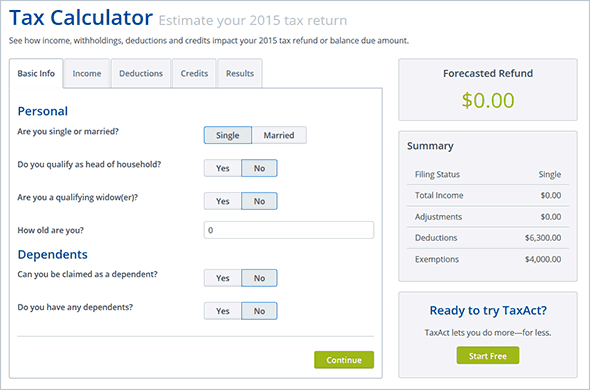

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

:max_bytes(150000):strip_icc()/tax_returns_-5bfc3256c9e77c00519be8b1.jpg)

How To Report Your Interest Income Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Tax Year 2022 Calculator Estimate Your Refund And Taxes